Save Up to $250,000 for Your Business from Research and Development

Claim your R&D Tax Credit with Confidence

Maximize your savings and trust Breakthrough Consulting's team of tax specialists to file your R&D Tax Credit with compliance in mind and in a timely manner – allowing you to get back to what you love doing.

Save Up to $250,000 for Your Business from Research and Development

Claim your R&D Tax Credit with Confidence

Maximize your savings and trust the Breakthrough Consulting's of tax specialists to file your R&D Tax Credit with compliance in mind and in a timely manner – allowing you to get back to what you love doing.

What is the R&D Tax Credit?

The Research and Development Tax Credit (R&D) helps businesses retrieve dollar for dollar reductions in their company’s tax liabilities for research and experimentation efforts that support the creation and distribution of new products and services.

Breakthrough Consulting helps organizations get the funding they deserve for the efforts they contribute to research and development activities. We work with you to ensure that your IRS Form 6765 is filed appropriately, maximized for the greatest return, and executed in compliance with federal guidelines.

We offer compliance-driven and tech-enabled filing services. Retrieve up to $50K or more with our team of tax specialists. We’ll even make sure that while you’re filling for the R&D Tax Credit that you’re not missing out on other tax credit filings you may be eligible for.

Offering over 100+ years of tax experience.

Our team of tax specialists guarantees that your experience is professional, timely, and compliance-driven – saving you time, money, and resources.

How To Apply

Step 1

Fill out the form above to start your application and determine if you qualify.

Step 2

Use our proprietary technology to securely upload all relevant documents and information to our tax credit team.

Step 3

We'll take your information, prepare it and submit it for filing with the IRS with our secure and compliance-focused technology.

Why Work with Breakthrough Consulting?

Breakthrough Consulting allows business owners to unlock the full potential of economic relief programs and specialized tax incentives, like ERC.

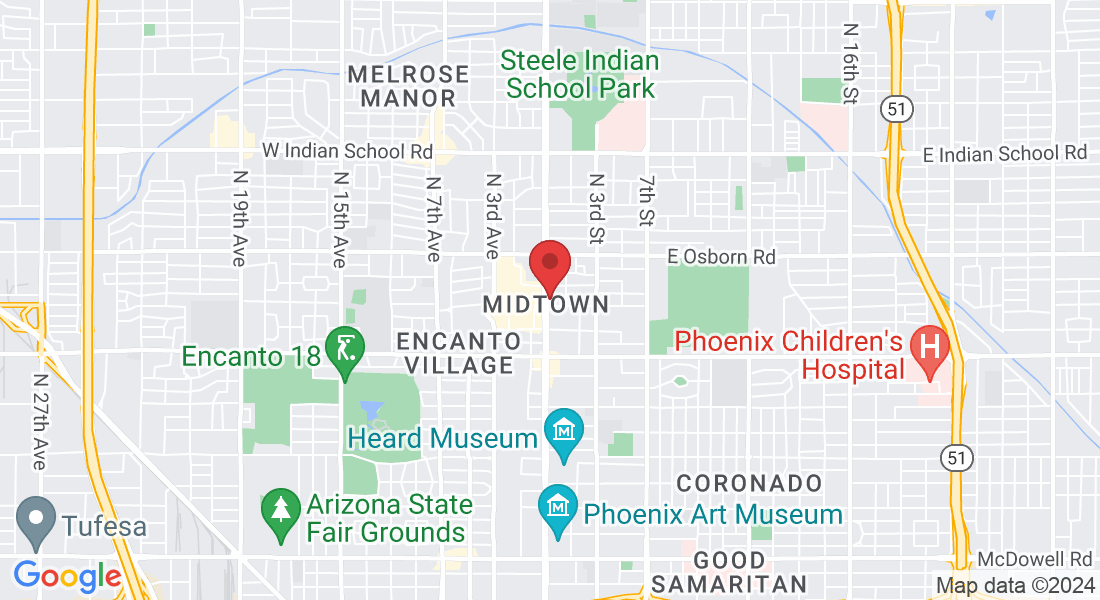

We believe in a professional, accelerated approach to tax solutions for businesses and stand on our hassle-free promise to customers that their ERC filing will always be compliance-driven and accessible. Using proprietary technology, our U.S.-based ERC team provides experience and services that are second to none while focusing on fully maximizing your return. With offices from New York to Phoenix, we exist to maximize your ERC filing with compliance in mind.

Specialist in Employer Retention Tax Credits – Always Up to Date on IRS Rules and Guidelines

Proprietary BC OS, Tax-Technology – Maximizing Your Credit or Refund

Fast File Processing – Industry Leading 12 Days to File

Employer Compliance Dashboard – Keeping Clients Informed and Compliant

Dedicated Account Manager – Here for You Every Step of the Way

Integrated Audit Protection and Legal Support – Confidence and Piece of Mind

Common Questions About R&D

What is Research & Development Tax Credit?

The Research and Development (R&D) tax credit, also known as Research and Experimentation (R&E) tax credit is a United States government sponsored tax initiative. It results in a dollar for dollar reduction in a company’s tax liabilities and is one of the best things American businesses can do to reduce their liability tax. Companies can submit documentation to file using the IRS Form 6765. The research and experimentation tax credit was essentially designed as an incentive to make research activities more affordable for businesses, strengthening American innovation.

How do I qualify?

Many businesses are not aware if they actually meet eligibility qualifications. Some believe there are special rules needed to qualify. While the correct documentation is required, in reality, over 60 industries can qualify for R&D credit in over 30 states, to offset tax liabilities. Some businesses’ daily operations can even qualify them, allowing them to receive basic research credit if it puts them over a certain base amount. Even start-ups can use this to their advantage.

Here are some of the factors small businesses and large businesses alike must be doing to qualify:

Create new or innovative products

Change existing products

Create new processes, techniques, prototypes, or software development

Hire engineers and designers for internal use or contract research to complete the job

What should you pay attention to?

To file, you must claim some of the credit as a payroll tax credit against the employer section of your social security taxes. It is calculated based on the increases in research expenditures and activities. Small businesses can even use R&D credit to offset payroll taxes of a current tax year if their expenditures are greater than a certain base amount. Companies can no longer expense costs identified as IRC Section 174 research expenses. Instead, these expenses are charged to a capital account and deducted over 5-years.

©Copyright | Breakthrough Consulting LLC. All Right Reserved