Get Up to $26K Per Employee with Employee Retention Credits

More than 3.4B in Stimulus Funds Retrieved for 4000+ Companies

Made personnel adjustments due to issues with supply chain, capacity, project delays, or other COVID-related challenges? You may qualify to file for ERC!

Get Up to $26K Per Employee with Employee Retention Credits

More than 3.4B in Stimulus Funds Retrieved for 4000+ Companies

Made personnel adjustments due to issues with supply chain, capacity, project delays, or other COVID-related challenges? You may qualify to file for ERC!

What is the ERC?

Employee Retention Credits (ERC) help businesses keep employees on payroll and was introduced through the CARES Act in March 2020

Working with Breakthrough Consulting to apply for ERC ensures that what you file is compliance-driven and optimized for you to receive a maximum return. We provide hassle-free filing solutions for the Employee Retention Credit, as well as other tax solutions for businesses.

Already filed for PPP?

The IRS has now allowed businesses who before had to pick between the Paycheck Protection Program (PPP) and ERC to most likely use both stimulus programs. Connect with our team to make sure that you’re not leaving money on the table!

How To Apply

Step 1

Fill out the form above to start your application and determine if you qualify.

Step 2

Use our proprietary technology to securely upload all relevant documents and information to our tax credit team.

Step 3

We'll take your information, prepare it and submit it for filing with the IRS with our secure and compliance-focused technology.

Why Work with Breakthrough Consulting?

Breakthrough Consulting allows business owners to unlock the full potential of economic relief programs and specialized tax incentives, like ERC.

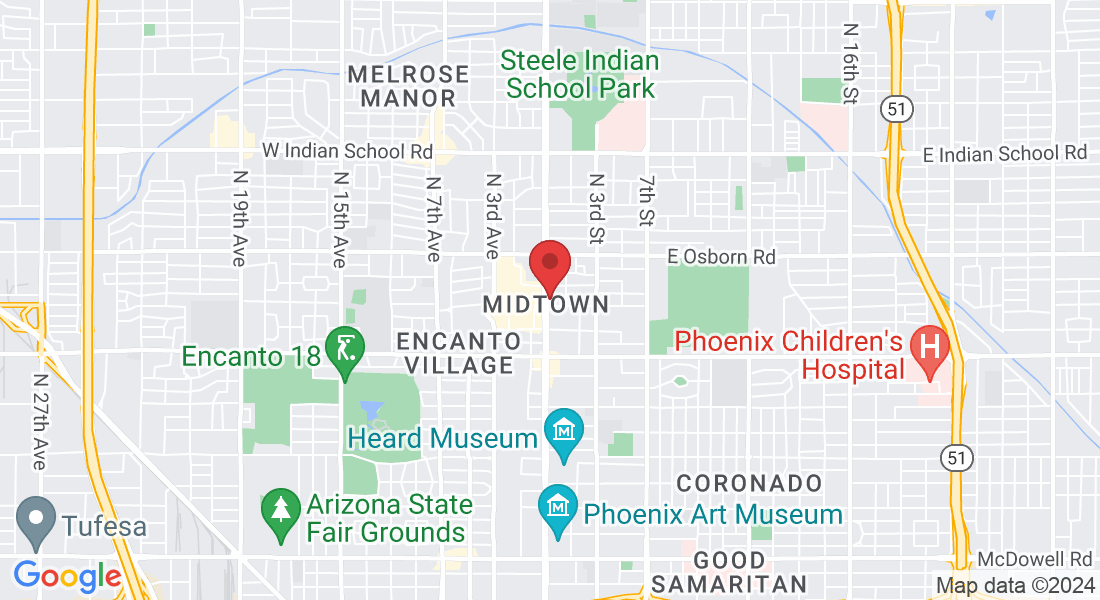

We believe in a professional, accelerated approach to tax solutions for businesses and stand on our hassle-free promise to customers that their ERC filing will always be compliance-driven and accessible. Using proprietary technology, our U.S.-based ERC team provides experience and services that are second to none while focusing on fully maximizing your return. With offices from New York to Phoenix, we exist to maximize your ERC filing with compliance in mind.

Specialist in Employer Retention Tax Credits – Always Up to Date on IRS Rules and Guidelines

Proprietary BC OS, Tax-Technology – Maximizing Your Credit or Refund

Fast File Processing – Industry Leading 12 Days to File

Employer Compliance Dashboard – Keeping Clients Informed and Compliant

Dedicated Account Manager – Here for You Every Step of the Way

Integrated Audit Protection and Legal Support – Confidence and Piece of Mind

Common Questions About ERC

Who's eligible?

There are two main ways to be eligible for stimulus refunds:

1) Employers are eligible for ERC if they match the required decline in revenue within any quarter of 2020 or 2021.

2) Employers are eligible if they experienced a more than nominal impact to their operations due to a full or partial government-mandated shutdown.

Depending on how much qualified wages were paid to employees, up to $5,000 can be credited per employee from March 13, 2020, to Dec. 31, 2020 as well as up to $21,000 per employee between the period of Jan. 1, 2021, to September 30th 30, 2021. Depending on how large your company is, you could earn up to six or seven figures back in funding. Eligibility can be determined by electing to use the immediately preceding calendar quarter.

How do I qualify?

Many industries faced decline during the pandemic. If your company’s gross receipts were 50% lower in a certain quarter than they were in the same quarter of 2019, pre-Covid-19, your business qualifies to file for ERC. Since there have been several changes within the last year regarding Employee retention Credit, many businesses are disqualifying themselves based on rumors, when in reality, they could very well qualify.

If your business has faced any of the below during 2020 or 2021, you may qualify:

- Full or partial shutdown

- Significant decline in sales

- Full or partial suspension in business

- Supply chain or distribution interruption

- Inability to access equipment

- Interrupted operations

- Reduction in operation hours

- Reduction in customer & client interaction

- Switching hours for sanitation reasons

- Faced decrease in providing services

If your business belongs to one of the following industries, you could qualify for credits:

- Education – colleges and universities

- Non-Profit or tax-exempt organizations

- Government

- Hospitality and Retail

- Industrial

- Real Estate and Construction

- Technology

Both essential and non-essential businesses are eligible for the payroll tax credit. All businesses were forced to adapt to safety restrictions and even face a partial shut down due to the pandemic. The Employee Retention Tax Credit (ERC) is the government’s way to give back to businesses and essentially reward them for keeping employees on payroll, even if these employees were forced not to work.

How does it work?

ERC is important because it can be responsible for increasing the chances of success for large organizations, small businesses and startups alike. If you are an eligible employer, filing for Employee Retention Credit can offset or eliminate payroll taxes and is currently one of the largest refunds businesses can get. Keep in mind that once filed, it can take up to nine months to receive your credit.

The statute of limitations for the ERC in 2020 and 2021 do not close until April 15, 2024 and April 15, 2025 respectfully. If your business is eligible for stimulus credit, you have until the deadlines to file. However, knowing the timeliness it can take to receive credits, it is wiser to file as soon as possible. You can file by reducing your payroll taxes sent to the Internal Revenue Service (IRS).

A common question around ERC is if it needs to be paid back. To answer, ERC does not have to be paid back as it is not a loan. However, you cannot take ERC into income when you receive it. You must instead reduce deductions for wages on your income tax return.

Did you know that 99% of businesses are small to medium sized companies? Smaller companies have different benefits of ERC than larger companies. Small employers can include wages paid by all employees while larger companies can only include those who were not performing work services.

©Copyright | Breakthrough Consulting LLC. All Right Reserved